Hello, friends in this blog post we will see information about what is credit score and how to improve it. If you took a loan or credit card, So you should have to read this article to maintain your credit score.

What is a Credit Score?

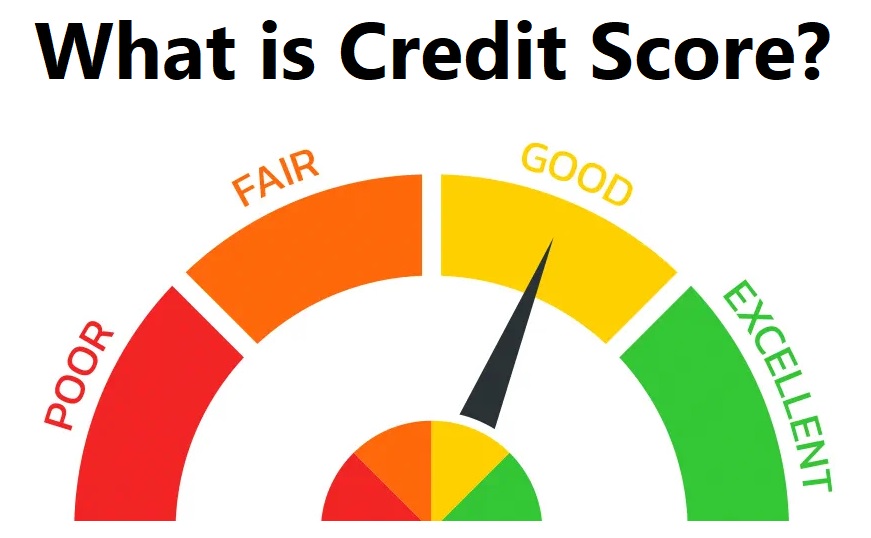

A credit score is a number usually from zero to a thousand which gives lenders an indication and how risky it is to lend money to you. There is three company in Australia that provides these credit reports and these are listed below:

- Experian

- Equifax

- lllion

This company will give you different types of credit scores, depending on what is your credit history. The main difference between each of these companies is looking at different things when they are giving you scores. When do look back at your credit report it might be slightly different depending on the credit report that you get depending on the company.

A higher credit score indicates lower risk and a lower credit score indicates higher risk. They also look at their income, savings, and expenses as well.

If you have a good credit score they may give you a special deal on loans. So this may mean lower interest rates on loans this doesn’t happen very often but this could happen more happen in the future.

What affect your credit scores?

So there are quite of things that can affect your credit scores and these things include

*Getting disapproved for credit cards or loans

If you apply for multiple credit cards and multiple loans and you have got denied for any one of these credit cards or loans this can impact your credit card negatively credit score. So these are some things that can negatively impact your credit score.

How to improve your credit score?

So the first thing we can do is maybe not apply for too many lines of credit cards at the same time and you can actually check your personal loans in the finder app. ( This is one of the best apps in Australia to check the credit score ).

You are actually able to see how likely it is for you to get accepted for these credit cards or loans.

If we get denied from a personal loan or credit card this can negatively impact our score, So doing a simple search on the finder app and seeing whether it’s likely that you would get accepted can really help you with your credit score as well.

How to see your credit score?

You can use the Finder app to see your credit score. As you can see the credit score like 800 ( which is excellent ). And you can also see your credit report ( this credit report is provided by the Experian company ). Here you can see the credit inquiries.

Therefore we are telling you guys don’t apply for too many credit cards or loans at the same time because if you get denied from any of these credit cards it can negatively impact your credit scores.

You can see your credit cards as per your requirement ( if your score is very low ) you can get MasterCard or any low-value cards.

Hope you guys get the information about the credit score.