So in this blog post, I will share information about how to submit tax information on an Adsense account ( Youtube ). All the information is provided below. Just read the full article for your kind of information.

How to Submit tax information on youtube AdSense?

On your Adsense account, there is pop up notification that is

Check if additional information required from you. All youtube creators and partners are required to submit tax information to ensure any applicable taxes on your payment are accurate.

Then click on the Manage Tax info.

After that, there will be and another option

ADD TAX INFO ( Blue Button )

After that new Page will be open and ask for the password of your Email ID.

Then Filled your password which you have an Adsense account.

Now the main information we have to submit here.

The United States Tax Info

Then you will have to choose the Individual or Non-Individual / Entity.

When I submitted the form ( I am an Individual )

After that click on the Next button.

Next option is

Are you a citizen or resident of the United stated?

- Yes

- No

There are two forms:

W-8BEN

W-8ECI

W-8BEN: This form is most commonly used by the non-US individual and would also be used to claim tax treaty benefits.

W-8ECI: This form is most commonly used by the non-US Business entity or individual that earns income related to its US trade or business and files a US Income tax return.

In simple language, I like to tell you that,

W-8BEN – individual

W-8ECI – Business entity

So if you are an individual so choose the W-8BEN Form and If you are the Business entity W-8ECI.

After that click on the Next button.

In my case, I choose this option ( because I am individual person )

W-8BEN – individual

The form will be open

*Tax Identity

Name of the Individual, DBA ( optional ) and Select your country.

Then main information is

Foreign TIN ( Submit your PAN Card Number ) here.

You can also US ITIN or SSN Number.

Then click on the next button.

*Address

Select country and submit your address as you have already submiited when you created the adsense account.

Address line 1

Address line 2

Town / City

Pin code

*Tax treaty

Are you claming a reduce rate of withholding under a tax treaty

Yes

No.

So click on the yes Button.

And select your country.

- Then click on the Service ( Article 7 and 0 % Reduce Rate )

- Motion piture and Tv ( Youtube Google play ) – ( Article 12and 15 % Reduce Rate )

- Other Copyright ( Youtube Google play ) – ( Article 12and 15 % Reduce Rate )

See this carefully ( when you submited the information ).

*Documet Preview

Then click on the Confirm button. The form will be show there on the right hand side. Then click on the next button.

After that again enter your Full legal name

Which you have already given on the adsense account ( at the time of creating adsense account )

After clicking on the Next button.

If you have already receive payment click on that option

If you dont take any payment from the adsense click on that option.

Choose According to you.

And this is the Final steps guys:

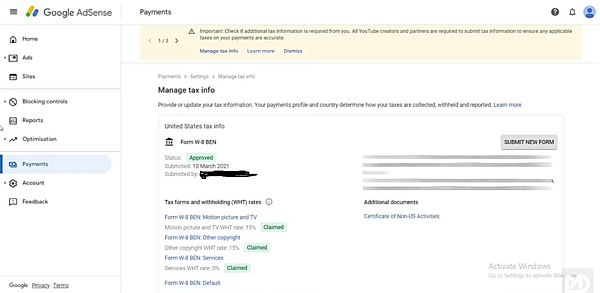

Now you have succesfully submitted your tax info:

Maage Tax Info:

- Status: Approve

- Submitted: 27-May-2021

- Submittd by: XYZ

Below that ther is Tax forms and Witholding Rates ( WHT ) Rates:

Claimed option you will have to see on the Adsense Account.

For Confirming you will get the Email on your adsense Account ( E-Mail ID )

Ok so this is procedure to Submit your tax information on your youtube adsense Account.

when i am wrting this article, So last date is 31 May 2021.